Short-term Health Insurance for Travel

Traveling is an exciting adventure that opens up new horizons, cultures, and experiences. However, amidst the excitement, it’s essential to consider the practicalities, such as health insurance. Short-term health insurance for travel is a critical component of planning any trip, whether it’s a brief business trip or an extended vacation. This guide will help you understand the importance, benefits, and options available for short-term health insurance for travel, ensuring you can enjoy your journey with peace of mind.

What is Short-term Health Insurance for Travel?

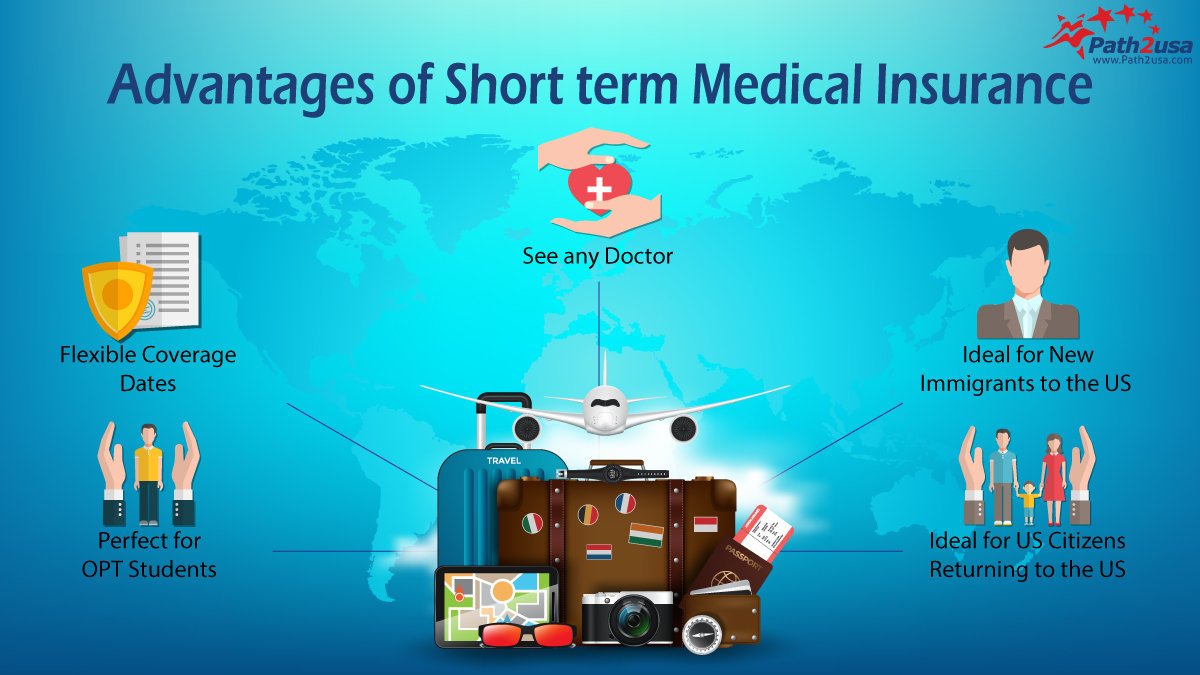

Short-term health insurance for travel, often referred to as travel medical insurance, provides coverage for medical expenses incurred while you are away from your home country. This type of insurance is designed to cover unexpected health issues, such as illness or injury, that might occur during your trip. Unlike regular health insurance, travel medical insurance is tailored to the unique needs of travelers and typically covers a shorter duration, from a few days to several months.

Why is Short-term Health Insurance Important?

Traveling without adequate health insurance can lead to significant financial risk. Medical emergencies abroad can be costly, and without insurance, you might be responsible for paying these expenses out of pocket. Here are a few reasons why short-term health insurance for travel is crucial:

- Emergency Medical Coverage: It covers emergency medical treatment, hospitalization, and sometimes even emergency evacuation to the nearest suitable medical facility.

- Financial Protection: It protects you from the high costs of medical care in foreign countries, where healthcare expenses can be significantly higher than at home.

- Peace of Mind: Knowing you have coverage can alleviate stress and allow you to enjoy your trip more fully.

- Compliance with Visa Requirements: Some countries require proof of health insurance as part of their visa application process.

Types of Coverage in Short-term Health Insurance for Travel

Short-term health insurance plans for travel can vary widely in terms of coverage options. Here are some common types of coverage you might find in these plans:

Medical Expense Coverage

This is the core component of travel medical insurance. It covers the costs of medical treatment if you fall ill or get injured while traveling. This can include doctor visits, hospital stays, surgery, prescription medications, and more.

Emergency Evacuation and Repatriation

In the event of a severe medical emergency, you might need to be transported to a different medical facility or even back to your home country. Emergency evacuation and repatriation coverage ensure these costs are covered.

Trip Interruption and Cancellation

While not always included in basic plans, some short-term health insurance policies offer trip interruption and cancellation coverage. This can reimburse you for non-refundable trip costs if your journey is interrupted or canceled due to a covered medical emergency.

Accidental Death and Dismemberment (AD&D)

AD&D coverage provides a benefit to your beneficiaries if you suffer a fatal accident or lose a limb while traveling. This type of coverage is often included in comprehensive travel insurance plans.

Dental Emergencies

Some plans also offer coverage for dental emergencies, which can be a valuable addition given the potential high cost of dental care in some countries.

How to Choose the Right Short-term Health Insurance for Travel

Selecting the right travel health insurance can be overwhelming due to the numerous options available. Here are some key factors to consider when choosing a plan:

Destination

Your destination plays a significant role in determining the type of coverage you need. Some countries have higher healthcare costs, and certain regions may have specific health risks that require additional coverage.

Duration of Stay

The length of your trip will affect your insurance needs. Ensure that your plan covers the entire duration of your stay abroad.

Coverage Limits

Different plans offer varying coverage limits for medical expenses, evacuation, and other benefits. Evaluate these limits to ensure they meet your needs.

Pre-existing Conditions

If you have any pre-existing medical conditions, check whether they are covered by the insurance plan. Some policies may exclude coverage for these conditions, while others may offer it with certain restrictions.

Policy Exclusions

It’s essential to understand what is not covered by the insurance policy. Common exclusions can include injuries from extreme sports, non-emergency medical treatments, and more.

Cost

While cost should not be the sole determining factor, it’s important to choose a plan that provides good value for money. Compare different plans to find one that offers comprehensive coverage at a reasonable price.

Top Providers of Short-term Health Insurance for Travel

There are many reputable insurance companies that offer short-term health insurance for travelers. Here are a few top providers known for their comprehensive coverage and excellent customer service:

Allianz Global Assistance

Allianz offers a variety of travel insurance plans, including short-term health insurance. Their plans are known for extensive coverage options, including emergency medical expenses, evacuation, and trip interruption.

World Nomads

World Nomads specializes in travel insurance for adventurous travelers. They offer coverage for a wide range of activities and sports, making them a popular choice for those with active travel plans.

IMG Global

IMG Global provides a range of travel medical insurance plans that cater to different needs and budgets. Their plans include coverage for medical expenses, evacuation, repatriation, and more.

Seven Corners

Seven Corners offers comprehensive travel medical insurance plans with a focus on emergency medical coverage and evacuation. They also provide coverage for trip interruption and cancellation.

How to File a Claim

Filing a claim with your travel health insurance provider is a straightforward process, but it requires you to follow certain steps to ensure a smooth experience:

- Contact the Insurance Provider: Notify your insurance company as soon as possible if you need medical treatment or face an emergency.

- Gather Documentation: Collect all necessary documents, such as medical reports, receipts, and proof of travel arrangements.

- Submit the Claim Form: Complete the claim form provided by your insurance company and submit it along with the required documentation.

- Follow Up: Keep in touch with your insurance provider to track the progress of your claim and provide any additional information if needed.

Common Questions about Short-term Health Insurance for Travel

Is Short-term Health Insurance for Travel Expensive?

The cost of short-term health insurance for travel varies depending on factors like your age, destination, duration of travel, and the coverage limits of the plan. Generally, it is affordable and provides significant value given the potential high costs of medical care abroad.

Can I Purchase Travel Health Insurance After Departing?

Most insurance providers require you to purchase travel health insurance before you depart. However, some companies may offer policies that can be bought after you have already left your home country, though they might come with certain restrictions or waiting periods.

Does Travel Health Insurance Cover COVID-19?

Many travel health insurance plans now include coverage for COVID-19 related medical expenses. It’s essential to check the specific terms of the policy to understand what is covered, as this can vary between providers.

How Soon Should I Buy Travel Health Insurance?

It’s advisable to purchase travel health insurance as soon as you book your trip. This ensures you are covered for any unexpected events that might occur before your departure, such as trip cancellation due to medical reasons.

What if I Have a Pre-existing Condition?

Coverage for pre-existing conditions varies by insurer and policy. Some plans may exclude pre-existing conditions, while others may offer coverage with certain conditions. It’s important to read the policy details carefully and consult with the insurance provider if you have any specific health concerns.

Conclusion

Short-term health insurance for travel is an essential investment for any trip abroad. It provides critical protection against unexpected medical expenses, ensuring you can travel with confidence and peace of mind. By understanding your needs, evaluating different coverage options, and choosing a reputable insurance provider, you can find the right plan to safeguard your health while you explore the world. Safe travels!