Understanding Short-Term Health Insurance Plans

Introduction

Health insurance is a critical aspect of managing one’s health and finances. However, traditional health insurance plans can sometimes be expensive or unavailable. This is where short-term health insurance plans come into play. These plans offer a temporary solution for those in need of immediate health coverage. In this comprehensive guide, we will delve into the details of short-term health insurance plans, exploring what they are, their benefits and drawbacks, and who might need them.

What Are Short-Term Health Insurance Plans?

Definition and Purpose

Short-term health insurance plans are temporary health insurance policies designed to provide coverage for a limited period, typically ranging from a few months to a year. They are intended to fill gaps in health insurance coverage, offering a safety net for those who are between jobs, waiting for other insurance to start, or in need of immediate coverage.

Duration of Coverage

These plans are usually not intended to be a long-term solution. Most policies last between one month and one year, with the option to renew for up to 36 months in some cases. However, the exact duration can vary depending on the state regulations and the insurance provider’s policies.

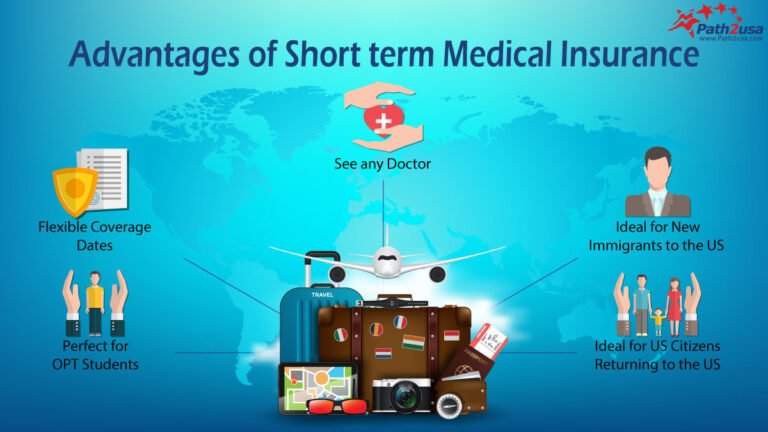

Benefits of Short-Term Health Insurance Plans

Quick and Easy Enrollment

One of the primary advantages of short-term health insurance plans is the ease and speed of enrollment. Unlike traditional health insurance plans, which often require enrollment during specific periods, short-term plans can be purchased at any time. This flexibility makes them ideal for individuals who need immediate coverage.

Lower Premiums

Short-term health insurance plans typically have lower premiums compared to traditional health insurance plans. This makes them an attractive option for individuals who are looking for cost-effective coverage. However, it’s important to note that lower premiums often come with higher out-of-pocket costs and fewer benefits.

Flexible Coverage Options

These plans offer a range of coverage options, allowing individuals to choose a plan that best suits their needs. Whether you need basic coverage for doctor visits and emergency care or more comprehensive coverage, there is likely a short-term plan that fits your requirements.

Drawbacks of Short-Term Health Insurance Plans

Limited Coverage

While short-term health insurance plans can be beneficial, they also come with significant limitations. These plans typically do not cover pre-existing conditions, preventive care, maternity care, or mental health services. This means that if you have ongoing health issues or require regular medical care, a short-term plan may not be the best choice.

Higher Out-of-Pocket Costs

Although the premiums for short-term health insurance plans are lower, the out-of-pocket costs can be higher. This includes deductibles, copayments, and coinsurance. Additionally, since these plans often do not cover certain services, you may end up paying more out-of-pocket for healthcare expenses that are not covered.

Lack of Protections

Short-term health insurance plans are not subject to the same regulations as traditional health insurance plans under the Affordable Care Act (ACA). This means they do not have to meet the minimum essential coverage requirements, which can leave you without coverage for essential health benefits.

Who Should Consider Short-Term Health Insurance Plans?

Individuals Between Jobs

If you are between jobs and do not have access to employer-sponsored health insurance, a short-term plan can provide temporary coverage. This can help protect you from high medical costs in case of an unexpected illness or injury while you are looking for a new job.

Recent Graduates

Recent graduates who are no longer covered by their parents’ health insurance plan and have not yet secured employment with health benefits can benefit from short-term health insurance. This provides a safety net during the transition period from school to the workforce.

Waiting for Other Coverage to Begin

Sometimes, there can be a gap between when one health insurance plan ends and another begins. For instance, if you are waiting for Medicare coverage to start or your new employer’s health insurance to take effect, a short-term plan can fill this gap.

How to Choose a Short-Term Health Insurance Plan

Assess Your Needs

Before choosing a short-term health insurance plan, it’s essential to assess your healthcare needs. Consider factors such as your current health status, any ongoing medical conditions, and the types of services you may require. This will help you determine the level of coverage you need.

Compare Plans

Take the time to compare different short-term health insurance plans. Look at the premiums, out-of-pocket costs, and coverage options. Make sure to read the fine print and understand what is and isn’t covered by each plan. This will help you make an informed decision.

Check State Regulations

State regulations regarding short-term health insurance plans can vary. Some states have stricter rules and may limit the duration of these plans or require certain benefits to be covered. Check the regulations in your state to ensure the plan you choose complies with local laws.

Consider the Provider’s Reputation

It’s also important to consider the reputation of the insurance provider. Look for reviews and ratings to get a sense of how other customers have experienced their services. A reputable provider is more likely to offer reliable coverage and good customer service.

Conclusion

Short-term health insurance plans can be a viable option for individuals in need of temporary health coverage. They offer quick enrollment, lower premiums, and flexible coverage options. However, they also come with limitations such as limited coverage, higher out-of-pocket costs, and lack of essential health benefits. Before choosing a short-term health insurance plan, it’s crucial to assess your needs, compare different plans, check state regulations, and consider the provider’s reputation. By doing so, you can find a plan that provides the coverage you need while protecting you from unexpected medical expenses.